OUR HERITAGE

Underwriting U since 1972

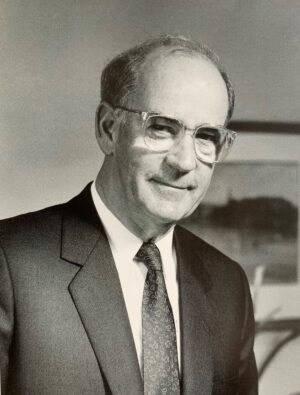

Founded in Melbourne in 1972 by insurance industry stalwart Richard Oliver, ROUM has a long and proud history. Below, Richard chats with the ROUM team on his and the company’s journey.

Richard's Story

I started in insurance in 1953, in Melbourne with Lumley’s, sending most Australian business to London underwriters. After World War II, underwriters were mainly British and there were a handful of brokers here, all locally owned. But things soon changed. American insurers and brokers came onto the Australian scene.

In the early 60s I moved on from Lumley’s to set up a local operation for another UK broker, but a few years later was approached by Marsh & McLennan to set up a Victorian office. I also joined the Marsh Australia board.

In 1972 I left Marsh to set up my own company, Richard Oliver International. I’d long held the belief that, although broking was an important role in the risk space, companies could benefit from a stronger focus on risk management. I was committed to creating a company to assist clients with a risk management focus, to improve their performance and enhance their risk transfer needs.

The risk management side of the business developed rapidly. We were fortunate that Australia, and Melbourne in particular, had a rich manufacturing sector. We developed strong relationships with a range of iconic companies, such as Pacific Dunlop, Elders and CSR. Our risk engineering services were engaged directly by the companies.

It was all about building strong relationships with the clients from the top down, with our people working in the clients’ premises from time to time. I recall a law firm used our company as a model for the development of client relationships.

We grew internationally as many of our clients expanded. We had offices in Wellington, Auckland, Christchurch, Singapore, Hong Kong, Chicago (our hub for the Americas), as well as Woking and London in the UK, where we had over 100 employees. Our appointments grew by word of mouth. We developed strong C-suite relationships and extended our capabilities to educational programs. We were invited by boards and managing directors to present on our capabilities.

We established self-insurance options for clients and a captive management business for retained risk and set up offices in Singapore and the Isle of Man for this endeavour. We were very proud of the work we did in establishing self-insurance capabilities. In collaboration with the Victorian government, we set up a workers’ compensation agency which grew to 21% market share in two years. Reluctantly, we sold this business as we were required to hold capital as an insurer, but our continued advocacy in the self-insurance space led to the development of such entities as the Victorian Managed Insurance Authority.

The birth of ROUM

Richard Oliver Underwriting Managers, ROUM, was set up as a separate entity to Richard Oliver International for two reasons.

In the 1970s, we developed a strong market involvement with large Australian manufacturers associated with the automotive industry, including the Repco group. In those days Repco was a major manufacturing company with many engineering subsidiaries. These clients were all concerned with the exposure to recall risks for which there was no insurance market.

Repco was a major participant in the Federation of Automotive Products Manufacturers. Through Repco, we proposed to investigate the development of a Product Liability and Recall insurance facility for the industry. We subsequently succeeded in placing a recall binder for the FAPM in the London market. I understand that this facility remains to this day with ROUM and London markets. Secondly, there were many occasions that we would have an appointment for the recall cover, and other lines of business were going to other brokers. Having the business housed in an underwriting agency, rather than a broker, ensured Chinese walls were observed. Integrity was a big company value.

Developing relationships

We developed product and carrier relationships in an era when technology was in its early stages. Simply, that meant a lot of travel and face-to-face contact. I would be in London once a month, to manage our business there and the relationships. I became a Lloyd’s name so that I could walk straight into Lloyd’s and negotiate with decision makers.

I remember an amusing story that has some resonance with the COVID-19 “working from home” situation. I remember concluding the FAPM deal in someone’s kitchen. That in itself wasn’t remarkable, but the next morning I was told the slip I signed the previous evening had been eaten by the dog. Everything had to be re-signed; the perils of working from home were evident 40 years ago!

An ongoing legacy

I was very pleased that ROUM conducted a recent survey looking at what the company name and brand means to clients and staff. It was clear that there remains a strong affinity to the themes of integrity, deep relationships, service and innovation. These were the heart and soul of the business and I’m pleased they have been retained. We saw our role as a “marriage” with our clients and a partnership with our carriers. We were not afraid to uphold some of those values with clients who held a purely transactional view. I recall we simply ceased working with two large clients on this matter of principle.

I ran the company until 1996 when the business merged and was eventually sold to what was then called Willis. I decided to sell mainly because my family did not have an interest in maintaining an involvement in the business. I had approaches to sell previously which I rejected; I had some ambition for the management team to be a part of a buyout which did not happen, so when it was time to retire, Willis came knocking with the idea of a merger. That meant a lot to me, as it secured a future for the staff, who I cared about.

I’ve enjoyed keeping the many personal connections I made during my years in insurance; I may have retired from the industry, but I did not retire from corporate life. Indeed, I was still actively working up until 2017. The ex-managing director of Repco is still a close personal friend. I’m delighted that I am still in close contact with many of our old RO team. This is very important to me. The real secret of our “success” was the quality and dedication of our team. I was often told that we were different in what we did and how we did it, and had good people.

A fresh look

The new ROUM logo looks very distinctive. It’s been developed to pay homage to our history, with the name and the colour scheme, but with a new, modern look and feel. The focus on “U”, being our clients and stakeholders is very strong and in keeping with the principles we’ve always held very close.

Our Products

Serving U.

ROUM combines technical capability, energy, creativity, commercial acumen and technology to develop optimal solutions for you.

Marine

A broad scope offering including: Annual Marine Cargo, Goods in Transit, Single shipments, Carriers’ Cargo Liability, Household and Personal Effects, General Property.

Specialist Liabilities

A wide range of specialist covers including: Business Product Recall, Contaminated Products, Life Science/ Biotechnology, Scientific & Medical Instruments, Cosmetic & Health Products.

WHAT OUR CUSTOMERS SAY

"Their attention to detail and customer service is second to none."

Recent News

Stories to captivate U.

Our latest thoughts and client success stories.

Need Some Help?

Visit Us

MELBOURNE

-

Level 32, 385 Bourke Street, Melbourne VIC 3000

SYDNEY

-

Level 16, 123 Pitt Street, Sydney NSW 2000

BRISBANE

-

Level 20, 123 Eagle Street, Brisbane QLD 4000